Pole Position in Customer Service – Gaining a Strategic Advantage with Agentic AI

Review of Swisscom & Spitch joint banking event on November 13, 2025 in Zurich

Swisscom and Spitch hosted a joint event for the banking industry in Zurich on November 13, 2025, with representatives from more then 25 banks in attendance. Under the title “Pole Position in Customer Service – Gaining a Strategic Advantage with Agentic AI,” representatives from various financial institutions discussed the future of their customer service centers and the role modern AI systems will play.

The focus was less on technical details and more on how banks can prepare their service organizations for new realities. The presentations showed that conversational AI is already established in many customer service centers: it recognizes customer needs, structures conversations, and supports employees in their daily tasks. However, further development of these systems remains crucial.

Collaborative Agentic AI: Collaboration Instead of Full Automation

The event spotlighted Collaborative Agentic AI Platform and solutions by Spitch – Virtual Assistants and other AI agents that understand conversations and actively handle routine automation and case management. They pursue defined goals, analyze dialogue in real time, and propose or execute next steps under human oversight. For predefined processes (e.g., FAQs and standard queries), they autonomously complete subtasks, stabilizing workflows and freeing staff for higher-value, empathy-driven work. For banks, this lowers costs and improves customer service – one of the top priorities confirmed by meeting polls.

The customer service representative remains the decision-maker, while the AI expands their options by providing context-aware prompts, precise information from the knowledge base, and guiding them through the case in a structured manner ensuring compliance. This interplay enables more precise work, faster responses, and more reliable results – benefiting both employees and customers.

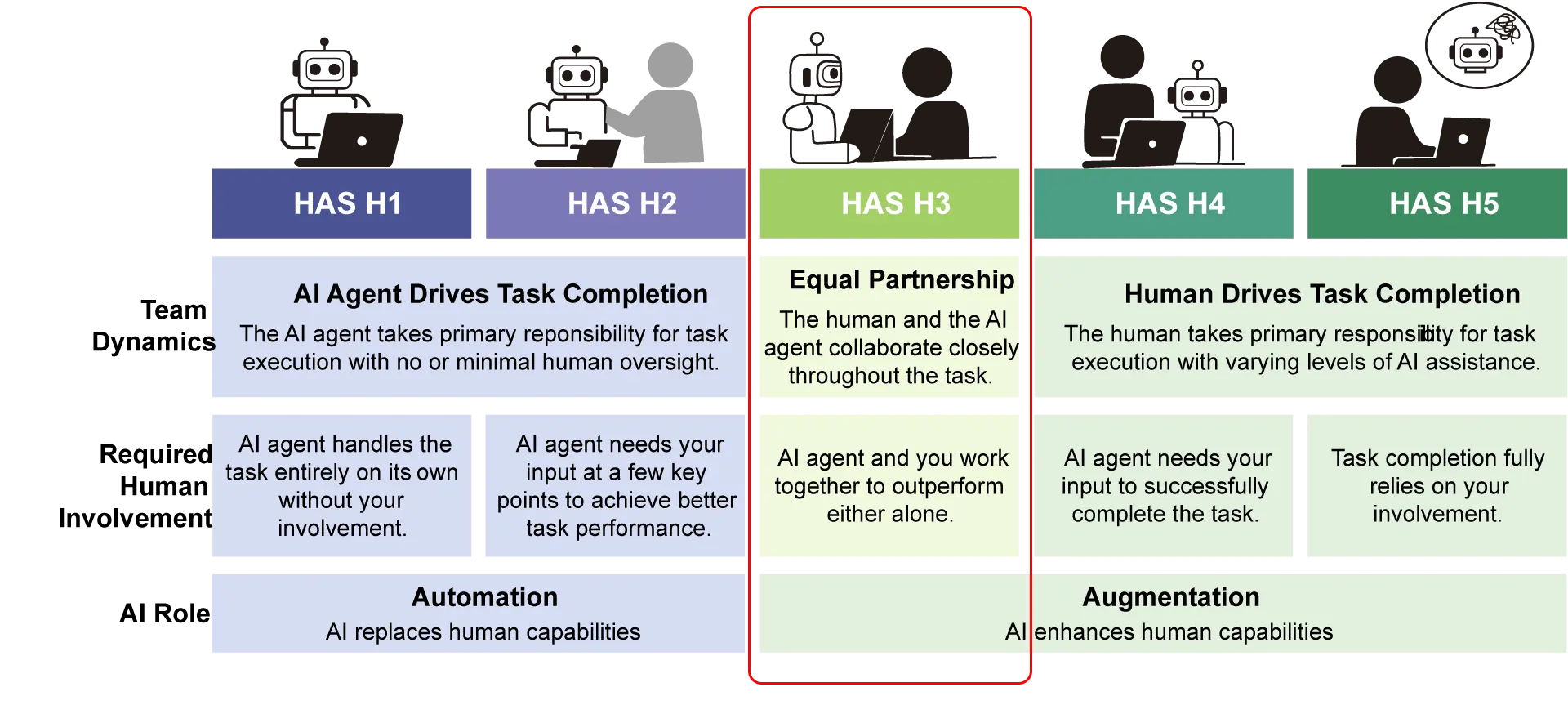

The Human Agency Scale (HAS) from Stanford University was used as a framework for classification.

The HAS Level H3 – “Equal Partnership” – is particularly relevant:

- Humans and AI work in parallel on the same task.

- AI provides context, structure, and suggestions.

- Decision-making authority remains clearly with humans.

In an increasingly digital world, distinctly human skills – complex judgment, empathy, and situational understanding – will remain critically important. Companies that empower their employees with Agentic AI create the foundation for sustainable performance and trustworthy customer relationships by maximizing the impact of both uniquely human skills and the power of AI.

Results from the Event Surveys

The surveys presented during the event revealed a consistent picture:

- Support rather than replacement: The majority of employees see AI as a helpful addition to their daily work.

- Improved orientation: Real-time feedback increases confidence in complex conversations.

- Transparency as a success factor: Clearly communicated roles and boundaries foster acceptance.

- Quality and consistency: Managers expect more reliable processes and more consistent conversation quality.

- Human involvement: Human participation and control is considered essential – both for trust and quality.

Conclusion

Creating a collaborative, unified human-AI workspace meaningfully improves service quality for banking customers. Although implementation requires investment, it pays off over the long term when strategically planned and executed.

Spitch and Swisscom support banks throughout this journey, from initial assessments and strategic planning through implementation. The partners combine technical expertise with a deep understanding of the needs of Swiss customer service centers.

Spitch thanks all participating banks, the speakers, and Swisscom, the co-organizer and consulting partner. The presentations and discussions emphasized the value of collaboration and knowledge exchange among financial institutions, technology providers, and consulting firms in advancing customer service.

Contact us at info@spitch.ai and visit our website at www.spitch.ch to learn more about Spitch solutions used by over 50 banking customers worldwide.