On 9-10 March 2016, Alexey Popov, the CEO of Spitch AG, participated in the bank innovation conference BankInno 2016. Spitch AG was the golden sponsor of the event and presented its state-of-the-art voice technologies at the conference. Key conclusions following the conference: banks are ready to invest in digital channels, are familiar with voice technologies, and intend to use them for big data analytics, IVR, and biometrics.

Mr. Popov has analyzed the situation in the world banking industry and drew the conference participants’ special attention to the fact that banks are facing the need for fundamental transformation. They are already under pressure from the global IT-companies and Fintech’s, which are actively expanding to financial services markets.

Mr. Popov has analyzed the situation in the world banking industry and drew the conference participants’ special attention to the fact that banks are facing the need for fundamental transformation. They are already under pressure from the global IT-companies and Fintech’s, which are actively expanding to financial services markets.

To remain competitive, the banks, as well as IT-giants, must rely on high-speed innovations and develop dynamic and flexible client service platforms: simple, comfortable and pleasant to use. Human voice adds a personal touch to digital channels. Voice technologies by Spitch AG make remote banking competitive by providing virtual customer support, voice biometrics, seamless mobile integration, and additional data source for targeted analytics.

Mr. Popov considers it essential to place a stake on voice technology, while ensuring high quality of user interface design and development of banking applications. According to Google, 50% of teens in the United States prefer voice search on their devices. Banks such as JP Morgan Chase, Wells Fargo, and others are using the voice technology for customer identity verification, fraud prevention, and application access control. The effectiveness of voice solutions by Spitch AG has been confirmed in the course of a pilot project for a major telecommunications company. Incoming call topic was precisely defined for over 90% of calls, and 84% of customer calls were processed in less than 1 minute. The system has the capability of flexible FAR and FRR parameters’ control, depending on the client's objectives.

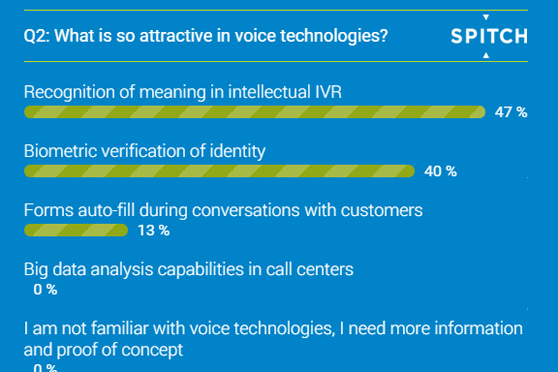

“What’s so attractive in voice technologies?” was one of the questions posed by Alexey Popov. “Personal verification, voice IVR, automatic speech recognition and transcription during conversations with clients, wide possibilities for data analysis in call processing centers:” all these provide business advantages in the highly competitive environment.

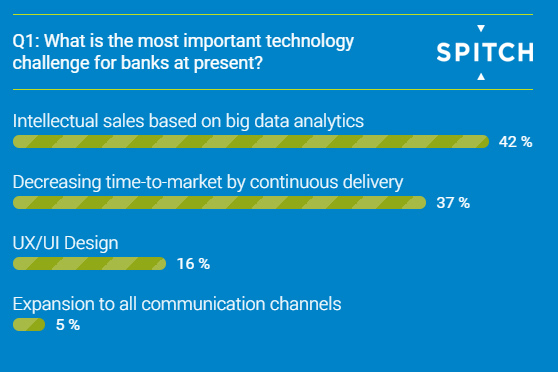

During the voting conducted in the course of Spitch AG presentation at BankInno 2016, 42% of banking executives confirmed that they want remote solutions to develop smart sales based on big data analytics. Voice technology by Spitch AG can deliver such targeted analytics and help banks interact with their customers effectively in all channels, providing personalized marketing and support services. Interactive voice response system for the automated call center solution is the most ambitious proposal. 40% of respondents believe that voice biometrics is the most attractive option of using voice technology.

During the voting conducted in the course of Spitch AG presentation at BankInno 2016, 42% of banking executives confirmed that they want remote solutions to develop smart sales based on big data analytics. Voice technology by Spitch AG can deliver such targeted analytics and help banks interact with their customers effectively in all channels, providing personalized marketing and support services. Interactive voice response system for the automated call center solution is the most ambitious proposal. 40% of respondents believe that voice biometrics is the most attractive option of using voice technology.

Spitch AG provides mobile application developers with voice set SDK which ensures easy access to the whole range of voice technologies in any application. The work on several pilot projects is presently going on at retail banks. Spitch is ready to embark on new POC projects for clients in order to demonstrate the significant advantages of its solutions in practice.

Spitch AG provides mobile application developers with voice set SDK which ensures easy access to the whole range of voice technologies in any application. The work on several pilot projects is presently going on at retail banks. Spitch is ready to embark on new POC projects for clients in order to demonstrate the significant advantages of its solutions in practice.

Case Study: Bankers vote for innovation

Case Study: How Spitch speaker verification technology can make your bank more efficient

Interview: Q&A with Alexey Popov, Spitch CEO